Coronavirus

COVID-19 Daily; LA County — masks ‘required,’ even at the beach

Newsom submits revised budget

LOS ANGELES, Calif. – In a reminder to all Angelenos Los Angeles County posted the hashtag “#BYOM” for “Bring Your Own Mask” to its Instagram Thursday, alerting residents and visitors that any beachgoers are “required to wear a mask when not in the water.” This edict followed Los Angeles Mayor Eric Garcetti’s Executive Order Wednesday which stated; “We’re requiring all Angelenos to wear face coverings when they leave the house. There are exceptions in place for small children or those with disabilities.”

The County, which originally had required all essential workers and anyone visiting an essential business to cover their faces, announced Thursday that health officials had also upgraded their policy on the use of face coverings, saying masks are now required whenever residents leave their homes in continuing efforts to slow the spread of the coronavirus.LA County had re-opened its beaches as of May 13 for individual exercise and similar physical activity including walking, running, swimming, and surfing.

It’s not clear, however, how the order will be enforced.

In addition to the now mandatory Face coverings are required at all times on the beach unless in the water, and the county urges everyone to keep at least six feet of physical distancing from other visitors. Once finished with an activity, all beachgoers are asked to head home.

For now, parking lots, piers, boardwalks, and biking paths will remain closed. Sunbathing, group sports, large gatherings, beach chairs, coolers, and umbrellas are not allowed to help ensure proper physical distancing.

If anyone headed to the beach feels sick or lives with someone who is sick, they are being asked to stay home.

The Los Angeles County Department of Public Health (LACDPH) confirmed 51 new deaths and 925 new cases of COVID-19. Three deaths were reported by the City of Pasadena and one death by the City of Long Beach. To date, LACDPH has identified 35,329 positive cases of COVID-19 across all areas of LA County, and a total of 1,709 deaths.

In California, as of Thursday, there were 74,806 cases of COVID-19 positive people and 3,049 deaths. In the United States, there have been 1,417,777 cases and 85,898 Americans have lost their lives.

In Sacramento today, Governor Gavin Newsom submitted his 2020-21 May Revision budget proposal to the Legislature – a balanced plan to close a budget deficit of more than $54 billion brought on by the COVID-19 pandemic and the closure of California’s economy necessitated by the Stay At Home measures implemented to arrest the spread of the virus.

“COVID-19 has caused California and economies across the country to confront a steep and unprecedented economic crisis – facing massive job losses and revenue shortfalls,” said Newsom.

“Our budget today reflects that emergency. We are proposing a budget to fund our most essential priorities – public health, public safety, and public education – and to support workers and small businesses as we restart our economy.”

“But difficult decisions lie ahead. With shared sacrifice and the resilient spirit that makes California great, I am confident we will emerge stronger from this crisis in the years ahead,” he added.

The Governor’s Office released a media statement detailing Newsom’s proposals and budgetary requests:

The May Revision proposes to cancel new initiatives proposed in the Governor’s Budget, cancel and reduce spending included in the 2019 Budget Act, draw down reserves, borrow from special funds, temporarily increase revenues and make government more efficient. Due to the size of the challenge, there is no responsible way to avoid reductions. The budget will show that the most painful cuts will only be triggered if the federal government does not pass an aid package that helps states and local governments.

The proposal responds to the dramatic economic and revenue changes since January when prudent fiscal management was reflected in a multi-year balanced budget plan with a $5.6 billion surplus and record reserve levels. The rapid onset of the COVID-19 recession in California has resulted in more than 4 million unemployment claims being filed since mid-March, the unemployment rate is now projected to be 18 percent for the year, and there is a $41 billion drop in revenues compared to January’s forecast. With a higher demand for social safety net services increasing state costs, the $54.3 billion deficit is more than three times the size of the record $16 billion set aside in the state’s Rainy Day Fund.

This recession-induced swing of nearly $60 billion in just four months underscores the necessity of additional federal funds to protect public health and safety, public education, and other core government functions, as well as to support a safe and swift economic recovery. If additional federal funds are not forthcoming, the May Revision spells out spending cuts necessary to meet the constitutional requirement for a balanced state budget.

While difficult decisions are required to close this sudden deficit as the state navigates to recovery, the May Revision is guided by principles of prudent fiscal management to protect public health, public safety, and public education; provide assistance to Californians who have been hurt the most by the pandemic, and invest in a safe and quick economic recovery.

Protecting Public Health, Public Safety, and Public Education

The May Revision proposes $44.9 billion in General Fund support for schools and community colleges and $6 billion in additional federal funds to supplement state funding. To address the decline in the constitutionally-required funding for schools and community colleges resulting from the COVID-19 recession, the May Revision proposes to reallocate $2.3 billion in funds previously dedicated to paying down schools’ unfunded liability to CalSTRS and CalPERS to instead pay the school employers’ retirement contributions. It also proposes a new obligation of 1.5 percent of state appropriation limit revenues starting in 2020-21 to avoid a permanent decline in school funding that grows to $4.6 billion in additional funding for schools and community colleges by 2023-24.

The May Revision prioritizes $4.4 billion in federal funding to address learning loss and equity issues exacerbated by the COVID-19 school closures this spring. These funds will be used by districts to run summer programs and other programs that address equity gaps that were widened during the school closures. These funds will also be used to make necessary modifications so that schools are prepared to reopen in the fall and help support parents’ ability to work. The May Revision also preserves the number of state-funded child care slots and expands access to child care for first responders.

The May Revision preserves community college free tuition waivers and maintains Cal Grants for college students, including the grants for students with dependent children established last year. Many workers return to higher education and job training after losing a job; continuing this initiative will prioritize affordability and access to these programs.

Supporting Californians Facing the Greatest Hardships

With the COVID-19 recession hitting harder on families living paycheck to paycheck, the May Revision prioritizes funding for direct payments to families, children, seniors, and persons with disabilities. It maintains the newly expanded Earned Income Tax Credit, which targets one billion dollars in financial relief to working families whose annual incomes are below $30,000 – and including a $1,000 credit for those families with children under the age of six. It maintains grant levels for families and individuals supported by the CalWORKs and SSI/SSP programs. It prioritizes funding to maintain current eligibility for critical health care services in both Medi-Cal and the expanded subsidies offered through the Covered California marketplace for Californians with incomes between 400 percent and 600 percent of the federal poverty level. It estimates unemployment insurance benefits in 2020-21 will be $43.8 billion – 650 percent higher than the $5.8 billion estimated in the Governor’s Budget.

The May Revision also targets $3.8 billion in federal funds to protect public health and safety. It also proposes $1.3 billion to counties for public health, behavioral health, and other health and human services programs, and also proposes $450 million to cities to support homeless individuals.

State Government Savings and Efficiency

In addition to baseline reductions in state programs, savings in employee compensation are also necessary in the absence of federal funds. Negotiations will commence or continue with the state’s collective bargaining units to achieve reduced pay of approximately 10 percent. The May Revision includes a provision to impose reductions if the state cannot reach an agreement. In addition, nearly all state operations will be reduced over the next two years, and nonessential contracts, purchases, and travel have already been suspended.

The COVID-19 pandemic has required an unprecedented shift to telework for the state government that has allowed state managers, led by the Government Operations Agency, to rethink their business processes. This transformation will result in expanded long-term telework strategies, reconfigured office space, reduced leased space, and flexible work schedules for employees when possible. The Administration also continues working with state departments in delivering more government services online – including the expansion of the Department of Motor Vehicles’ virtual office visits pilot to other departments and agencies with more face-to-face interactions with Californians.

Supporting Job Creation, Economic Recovery, and Opportunity

Given the critical role of small business in California’s economy, the May Revision proposes an augmentation of $50 million for a total increase of $100 million to the small business loan guarantee program to fill gaps in available federal assistance. This increase will be leveraged to access existing private lending capacity and philanthropy to provide the necessary capital to restart California small businesses. To support innovation and the creation of new businesses, the May Revision retains January proposals to support new business creation by exempting first-year businesses from the $800 minimum franchise tax.

Coronavirus

Newsom announces end of the COVID-19 State of Emergency

California’s pandemic response efforts have saved tens of thousands of lives, kept people out of the hospital and protected the economy

SACRAMENTO – Today, Governor Gavin Newsom announced that the COVID-19 State of Emergency will end on February 28, 2023, charting the path to phasing out one of the most effective and necessary tools that California has used to combat COVID-19.

This timeline gives the health care system needed flexibility to handle any potential surge that may occur after the holidays in January and February, in addition to providing state and local partners the time needed to prepare for this phaseout and set themselves up for success afterwards.

With hospitalizations and deaths dramatically reduced due to the state’s vaccination and public health efforts, California has the tools needed to continue fighting COVID-19 when the State of Emergency terminates at the end of February, including vaccines and boosters, testing, treatments and other mitigation measures like masking and indoor ventilation.

As the State of Emergency is phased out, the SMARTER Plan continues to guide California’s strategy to best protect people from COVID-19.

SMARTER Plan Progress Update

“Throughout the pandemic, we’ve been guided by the science and data – moving quickly and strategically to save lives. The State of Emergency was an effective and necessary tool that we utilized to protect our state, and we wouldn’t have gotten to this point without it,” said Newsom. “With the operational preparedness that we’ve built up and the measures that we’ll continue to employ moving forward, California is ready to phase out this tool.”

To maintain California’s COVID-19 laboratory testing and therapeutics treatment capacity, the Newsom Administration will be seeking two statutory changes immediately upon the Legislature’s return: 1) The continued ability of nurses to dispense COVID-19 therapeutics; and 2) The continued ability of laboratory workers to solely process COVID-19 tests.

“California’s response to the COVID-19 pandemic has prepared us for whatever comes next. As we move into this next phase, the infrastructure and processes we’ve invested in and built up will provide us the tools to manage any ups and downs in the future,” said Secretary of the California Health & Human Services Agency, Dr. Mark Ghaly. “While the threat of this virus is still real, our preparedness and collective work have helped turn this once crisis emergency into a manageable situation.”

Throughout the pandemic, Governor Newsom, the Legislature and state agencies have been guided by the science and data to best protect Californians and save lives – with a focus on those facing the greatest social and health inequities – remaining nimble to adapt mitigation efforts along the way as we learned more about COVID-19. The state’s efforts to support Californians resulted in:

- Administration of 81 million vaccinations, distribution of a billion units of PPE throughout the state and processing of 186 million tests.

- Allocation of billions of dollars to support hospitals, community organizations, frontline workers, schools and more throughout the pandemic.

- The nation’s largest stimulus programs to support people hardest hit by the pandemic – $18.5 billion for direct payments to Californians, $8 billion for rent relief, $10 billion for small business grants and tax relief, $2.8 billion to help with overdue utility bills, and more.

California’s pandemic response efforts have saved tens of thousands of lives, kept people out of the hospital and protected the economy:

- California’s death rate is the lowest amongst large states. If California had Texas’ death rate, 27,000 more people would have died here. If California had Florida’s rate, that figure jumps to approximately 56,000 more deaths.

- In only the first ten months of vaccines being available, a study showed that California’s efforts saved 20,000 lives, kept 73,000 people out of the hospital and prevented 1.5 million infections.

- California’s actions during the pandemic protected the economy and the state continues to lead the nation in creating jobs and new business starts:

- “‘Lockdown’ states like California did better economically than ‘looser’ states like Florida, new COVID data shows,” with California’s economy having contracted less than such states – economic output shrank 3.5% on average for the U.S., compared with 2.8% for California.

- Since February 2021, California has created 1,628,300 new jobs – over 16% of the nation’s jobs, by far more than any other state. By comparison, Texas created 1,133,200 jobs (11.3% of the nation’s) and Florida created 787,600 jobs (7.9% of the nation’s) in that same timeframe.

- Since the beginning of 2019, data from the Bureau of Labor Statistics shows that over 569,000 businesses started in California, by far more than any other state.

Coronavirus

L.A. County on track to bring back mandatory indoor masking

If LA county stays in CDC designated High Community Level for 2 consecutive weeks officials would implement a universal indoor masking

LOS ANGELES – The Los Angeles County Department of Public Health indicated that if the upward trend in coronavirus numbers continues, due to the increased circulation of the more infectious BA.4 and BA.5 Omicron subvariants coupled with increased community spread, officials may order a return to indoor masks.

On Friday, Public Health said that while the county currently remains at the CDC designated COVID-19 Medium Community Level. There are increasing concerns about the impact of new Omicron sub-variants on transmission and hospitalizations that could result in the County moving into the High Community Level designation sometime later this summer.

Barbara Ferrer, Director of LA County Public Health expressed concern and cautioned Angelenos as the region prepares for the July 4th holiday weekend.

“Since July 4 is right around the corner and many of us are looking forward to celebrating Independence Day with family and friends, it is important to remember that many of our loved ones may be older adults, or have serious underlying health conditions, or not yet been vaccinated and boosted,” Ferrer said.

“Given the rising number of COVID cases and hospitalizations, and the increased circulation of the more infectious BA.4 and BA.5 subvariants, it is extra important to take steps that reduce the risk of transmission especially over the long holiday weekend; this helps us protect ourselves, our families, and our community,” She continued adding, “With a little planning, you can have a great time celebrating while keeping each other safe. Please be sure to remind friends and family to stay home and skip the celebration if they feel sick or have tested positive. It is also a great idea for everyone to test themselves before getting together, ideally on the day of the gathering. It is always best to celebrate outdoors, and if people come indoors for part of the gathering, wearing a mask is advisable, particularly if there are individuals at high risk of severe illness should they become infected.”

LA County Public Health pointed out in a statement that six of the seven Early Alert metrics Public Health are tracking continue to convey cause for Medium or High Concern. Moreover, in the past week, four Early Alert Signals moved upward in the level of concern: The case rate in the lowest income areas and the number of new outbreaks at Skilled Nursing Facilities per week, both moved up to High Concern.

The number of new outbreaks in settings for People Experiencing Homelessness is now at Medium Concern. And the number of worksite clusters increased, moving from Medium to High Concern for the first time since Public Health started tracking this metric in early March.

There was also an uptick in the percentage of Emergency Department Visits. The only measure indicating Low Concern is the number of sewer systems with a two-fold increase in viral load.

The first of two hospital metrics in the CDC Community Levels Framework is the seven-day total of new hospital admissions per 100,000, which rose this past week to 8.1 admissions per 100,000 people. This is a 56% increase compared to one month ago. The second hospital metric, the seven-day average for the proportion of staffed inpatient beds occupied by COVID-19 patients, also increased this past week to 4.2%.

If the county moves into the CDC designated High Community Level and remains there for two consecutive weeks, the county would implement a universal indoor masking requirement for everyone age 2 and older in LA County as a safety measure aligned with the CDC framework. The safety measure would remain in effect until the county returned to the CDC Medium Community Level designation, or lower, for two consecutive weeks.

Coronavirus

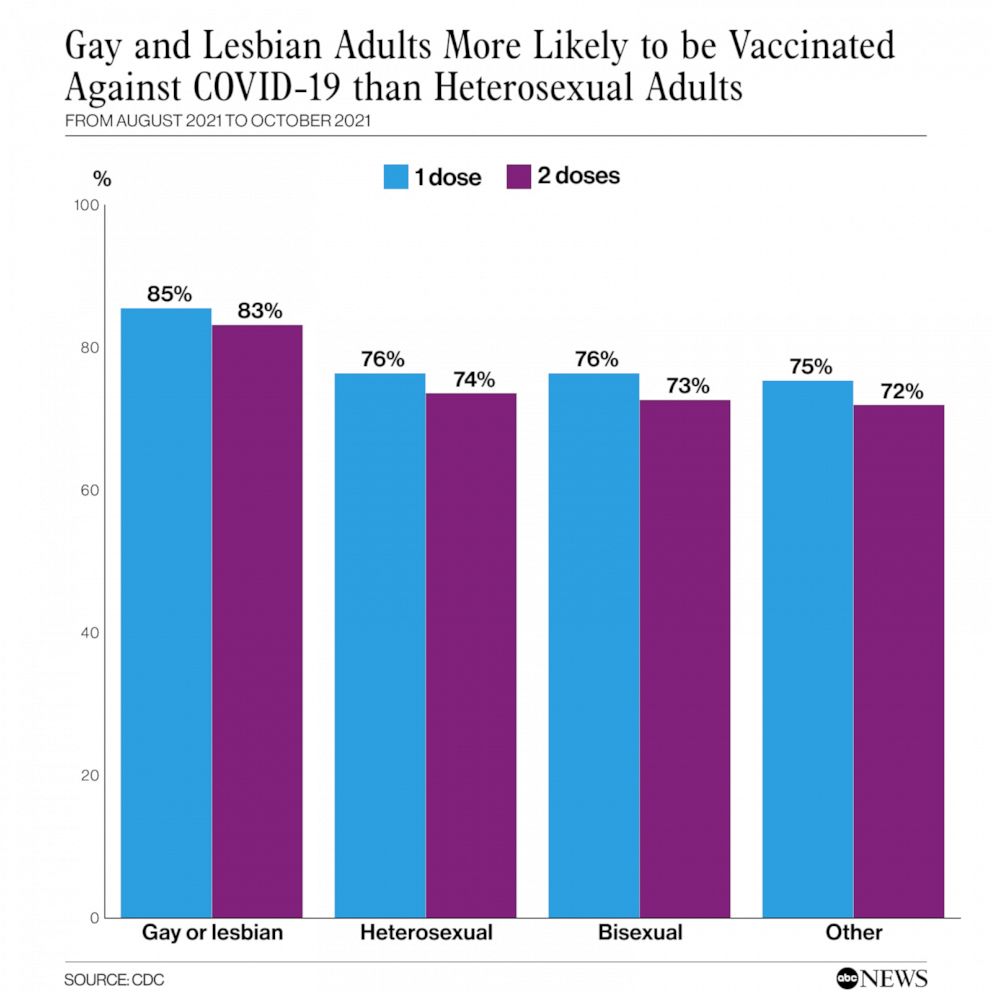

CDC: 85% of gay & lesbian adults in U.S. are vaccinated against COVID

Data on COVID-19 vaccination among LGBTQ persons limited because of the lack of routine SOGI data collection at the national & state levels

ATLANTA – A new study report released Friday by the Centers for Disease Control and Prevention, (CDC), found that found 85.4% of gay and lesbian Americans above age 18 had received at least one vaccine dose as of October 2021.

The study, conducted from August 29 until October 30, 2021, also found that by comparison, only 76.3% of heterosexuals reported receiving at least an initial dose by the same date.

The report noted that Lesbian, gay, bisexual, and transgender (LGBT) populations have higher prevalence of health conditions associated with severe COVID-19 illness compared with non-LGBT populations.

The potential for low vaccine confidence and coverage among LGBT populations is of concern because these persons historically experience challenges accessing, trusting, and receiving health care services

Data on COVID-19 vaccination among LGBT persons are limited, in part because of the lack of routine data collection on sexual orientation and gender identity at the national and state levels.

In March of 2021, the Blade reported the coronavirus (COVID-19) pandemic has revealed deep-seated inequities in health care for communities of color and amplifies social and economic factors that have contributed to those communities being hit hardest, and Mega-vaccination centers set up by California health officials and the Federal Emergency Management Agency have been addressing and tracking the issue- the LGBTQ communities are still not being tracked.

This lack of data collection has frustrated and angered California State Senator Scott Wiener who authored a bill last year that passed through the legislature and signed by Governor Gavin Newsom last Fall that mandates gathering sexual orientation and gender identity data related to the COVID testing in California.

“We’re one year into the pandemic, and LGBTQ people continue to be erased in our public health response to COVID-19 — similar to our invisibility throughout history. No government is successfully tracking COVID-19 cases in the LGBTQ community, despite a law I wrote mandating that California do so,” Weiner told the Blade. “And, we now know that LGBTQ people are more vulnerable to COVID-19. We’ve also just learned that vaccination demographic data doesn’t include LGBTQ data. It simply shocking that in 2021, progressive health agencies continue to forget about our community,” he added.

The CDC also noted that gay and lesbian adults were more likely to be concerned about COVID-19 and to believe in the safety and efficacy of vaccines.

“We know that the prevalence of certain health conditions associated with severe COVID-19 illness, such as cancer, smoking, and obesity, are higher in LGBT populations, and access to health care continues to be an issue for some people in the LGBT community,” Dr. A.D. McNaghten, a member of the CDC’s COVID-19 Emergency Response Team and corresponding author of the study, told ABC News. “We wanted to see if vaccination coverage among LGBT persons was the same as non-LGBT persons.”

The CDC data recorded that bisexual and transgender adults had similar vaccination rates to heterosexual adults with 72.6% of bisexual adults fully vaccinated by the end of October, as were 71.4% of transgender adults. The numbers however for Black and Hispanic lesbian women had lower rates of vaccination at 57.9% and 72.6%, respectively, compared to Black and Hispanic heterosexual women at 75.6% and 80.5%, respectively.

Higher percentages of gay or lesbian adults and bisexual adults reported that they thought COVID-19 vaccine was very or somewhat important to protect oneself (90.8% and 86.8%, respectively) compared with heterosexual adults (80.4%), and higher percentages of adults who identified as transgender or nonbinary reported they thought COVID-19 vaccine was very or somewhat important to protect oneself (83.2%) compared with those who did not identify as transgender or nonbinary (80.7%).

Coronavirus

White House orders distribution of 400 million free N95 masks

Dr. Tom Inglesby, the administration’s Covid testing coordinator; “We know that these masks provide better protection than cloth masks”

WASHINGTON – As the latest surge of the highly contagious and easily transmissible Omicron variant of the coronavirus continues to cause a rise in hospitalizations, especially among unvaccinated adults and children, the White House announced Wednesday it is making 400 million N95 masks available for free at thousands of locations across the nation.

The plan an admkistartion official said, is to start shipping the nonsurgical masks to pharmacies and community health centers to distribute this week, which will come from the Strategic National Stockpile.

In an interview with NBC News, Dr. Tom Inglesby, the administration’s Covid testing coordinator, said, “We know that these masks provide better protection than cloth masks.”

The N95 masks will be made available to everybody, and recipients will not be prioritized based on vulnerability to Covid, income or other criteria. Inglesby said the administration was “confident that people who want to access them will be able to access them,” but it was not immediately clear how many masks a person could receive at one time.

On January 13, President Joe Biden had announced a plan to have the government distribute 1 billion rapid, at-home COVID-19 tests free to Americans, along with the N95 masks, as the administration works to fight the spiraling upward spike in coronavirus cases.

The White House website to order free at-home Covid tests went live Tuesday. The website says: “Every home in the U.S. is eligible to order 4 free at-home COVID-19 tests. The tests are completely free. Orders will usually ship in 7-12 days.”

A White House official said Wednesday that the distribution of 400 million masks would be the largest deployment of personal protective equipment in U.S. history.

Inglesby told NBC News that the administration was “absolutely preparing for the possibility of additional variants in the future” and that people could expect the government to make N95 masks “more and more available.”

Biden announces free masks, tests to fight omicron:

Coronavirus

COVID-19 Cases increase by nearly 10 times in one month

While hospitalizations continue to climb, Public Health data shows that many positive cases are admitted for reasons other than COVID

LOS ANGELES – A total of 31,576 new COVID-19 cases were documented on Monday — up ten times the number of cases reported on Dec. 17, 2021, when there were 3,360 new cases recorded the Los Angeles County Department of Public Health reported Monday.

There are 4,564 people with COVID-19 currently hospitalized, nearly 6 times the number from one month ago when 772 people were hospitalized. The daily positivity rate is 16.5%, more than 8 times the 2% daily positivity rate on December 17th.

Just one week ago, the county surpassed 2 million total COVID-19 cases, with the figure reaching 2,289,045 cases as of Monday.

“On this national holiday where we celebrate the life and legacy of Dr. Martin Luther King, we remember his deep commitment to health equity. As Reverend King memorably said, ‘Of all the forms of inequality, injustice in health is the most shocking and the most inhuman because it often results in physical death,’ ” said Dr. Barbara Ferrer, Director of Public Health.

“Tragically, we have seen this play out in real life and very clearly over the past two years with the disparate impacts of the COVID-19 pandemic on people of color. From the onset of the pandemic, communities of color have experienced the greatest devastation from COVID-19 in Los Angeles County and throughout the nation,” she added.

“The good news is that while hospitalizations continue to climb, Public Health data shows that many positive cases are admitted for reasons other than COVID but, are identified with COVID when tested for COVID upon hospital admission,” the health department said in a statement released last week.

As of Friday, more than 80% of all adult ICU beds in the county were occupied.

There are also 27 new deaths due to COVID-19 in Los Angeles County and 31,576 new positive cases.

The public health department also noted that while the number of children hospitalized with the virus remains low, the number of them admitted to L.A. County hospitals “significantly increased” over the past month, with the largest increase among children younger than 5 years old.

The increase mirrors trends seen nationwide for the age group — the only one not yet eligible for the vaccine.

The county also saw its highest coronavirus death rate in nearly 10 months over this past week, with an average of 40 COVID-19 deaths a day.

“From the onset of the pandemic, communities of color have experienced the greatest devastation from COVID-19 in Los Angeles County and throughout the nation. As we continue to implement strategies – enforcing worker protections through our Health Officer Orders, providing resources needed by many to survive the impact of the pandemic, funding community-based organizations in hard hit areas to serve as trusted public health messengers, and increasing vaccination access in under-sourced neighborhoods – we also need to come together to address the impact that racism, historical disinvestment, and social marginalization have on COVID-19 outcomes,” Ferrer said.

“While these conditions predate the pandemic, without deliberate collective actions to address the root causes of health inequities, we are unlikely to close the gaps we have documented for 2 long years,” she added.

California has recorded more than 7 million coronavirus cases after its fastest accumulation of reported infections in the history of the pandemic, the Los Angeles Times reported.

The unprecedented count, recorded in California’s databases late Monday, comes one week after the state tallied its 6 millionth coronavirus case.

Coronavirus

Los Angeles County surpasses 2 million COVID cases

While hospitalizations continue to climb, Public Health data shows that many positive cases are admitted for reasons other than COVID

LOS ANGELES – Los Angeles County health officials are urging residents to postpone nonessential gatherings and avoid some activities – especially those that will include people who are unmasked, unvaccinated or at higher risk of severe COVID-19 illness.

This comes as Los Angeles County recorded a grim milestone Monday as the Department of Public Health reports that the County has now confirmed more than 2 million total cases of COVID-19 since the beginning of the pandemic.

The Los Angele Times reported early Tuesday that hundreds of thousands of Los Angeles Unified students returned to campus from winter break Tuesday morning amid a record-breaking surge in coronavirus cases.

As they stood in long lines to enter campus, the district’s health-screening system crashed. These conditions, including staffing shortages, student absences, and apprehensive parents and students, put the district’s carefully laid plans to open campuses in the nation’s second-largest school district to the test.

Although some students and parents were anxious amid the Omicron surge, they said they wanted to be back in the classroom. District leaders said strict campus safely precautions are in place, the Times reported.

The surge, which has now created uncertainty in the business community as some restaurants and other retail operations close up due to staffing shortages or out of caution, prompted County Public Health to ask that residents postpone nonessential gatherings just ahead of the long Martin Luther King Jr. Day holiday weekend.

Public Health officials are also concerned as LA-based Super Bowl is a mere month away. The recommendation is voluntary and officials have not imposed any new restrictions that could put any events in jeopardy.

The latest Public Health data shows vaccines are still the best way to protect against the coronavirus. In L.A. County cases have continued to increase rapidly across all groups however at significantly lower levels for vaccinated individuals. For the week ending December 25th, case rates were much higher for those unvaccinated. There were 991 new cases per 100,000 unvaccinated; 588 cases per 100,000 fully vaccinated without boosters; and 254 cases per 100,000 fully vaccinated with boosters.

The vaccine also continues to provide very strong protection against hospitalization and death. One way to evaluate the protection offered by vaccines is rate ratios. These ratios compare rates of an outcome in unvaccinated people with rates of the same outcome in fully vaccinated people. The higher the rate ratio, the more protective the vaccine is against the outcome.

The hospital rate ratio was 9 when comparing those unvaccinated vs those fully vaccinated without boosters, meaning a 9-fold higher rate of hospitalization for the unvaccinated compared to this protected group. More markedly, the hospital rate ratio was 38 when comparing the unvaccinated vs fully vaccinated with boosters, meaning those fully vaccinated and boosted were 38 times less likely to be hospitalized than those unvaccinated.

“With surging transmission and rapidly rising cases and hospitalizations, our already understaffed health care providers are under enormous strain as they try to care for so many COVID infected people,” Barbara Ferrer, L.A. County Health Director said.

About 14% of the patients with COVID-19 were in the ICU, and 7% were on a ventilator.

“The good news is that while hospitalizations continue to climb, Public Health data shows that many positive cases are admitted for reasons other than COVID but, are identified with COVID when tested for COVID upon hospital admission,” the LA County Public Health Department said in a news release.

“However, at the moment, vaccinations alone are not sufficient to get us back to slowing the spread. We all need to exercise more caution in the weeks ahead. One effective strategy for reducing transmission is to wear a high-quality mask whenever around non-household members,” Ferrer said.

“Given the dominance of the highly infectious Omicron variant, well-fitting masks provide a great layer of protection to both the wearer and all those nearby. It is also time to pause those non-essential activities where people are unmasked and in close contact with others. The reality is that parties and events, especially those indoors, make it easy for the virus to spread. Limiting our time with others to those more essential work or school activities is a prudent action for us to take when-ever possible until the surge subsides,” she added.

COVID-19 vaccines are safe and effective and are recommended for everyone 5 years old and older to help protect against COVID-19. Vaccinations are always free and open to eligible residents and workers regardless of immigration status. Appointments are not needed at all Public Health vaccination sites and many community sites where first, second, and third doses are available.

To find a vaccination site near you, or to make an appointment, please visit:

www.VaccinateLACounty.com (English) or www.VacunateLosAngeles.com (Spanish).

If you need assistance, you can also call 1-833-540-0473 for help:

- Finding an appointment

- Connect to free transportation to and from a vaccination site, or

- Schedule a home visit if you are homebound.

For more information regarding COVID-19 in LA County you can also visit the Public Health website at www.publichealth.lacounty.gov

Coronavirus

LA County launches new COVID test collection program

Testing partner sites listed on LA County’s website have been pre-screened to ensure that they offer testing with no out-of-pocket cost

LOS ANGELES – LA County Department of Health Services launches new program designed to increase and facilitate access to COVID-19 tests for LA County residents unable to obtain appointments. The program will allow residents to pick up a PCR test kit, perform the test, and return the completed kit to designated locations for processing. Residents will be notified of their test results within 24-48 hours.

The “Pick-Up Testing Kit” program is the latest in a series of LA County efforts designed to expand testing capacity as demand grows across the county. Recent efforts to increase capacity include increasing the days and hours of operation for existing sites, adding mobile testing units, and providing intermittent availability of Home Testing Kits via mail.

The new “Pick-Up Testing Kit” program will operate at 13 testing sites across LA County. “Pick-Up Test Kits” will be available without an appointment and until daily supplies are exhausted. The “Pick-Up Testing Kits” will test for both COVID-19 and Influenza (A and B), the same as all LA County operated testing locations.

“We look forward to reducing the waiting time to get tested for individuals unable to book an appointment,” said Paula Siler RN, MS Director of Community Mobile Testing Operations at the LA County Department of Health Services. “Once all 13 Pick-Up Testing locations are fully operating and once our Home Testing Kit by mail program is simultaneously relaunched later this week, we will have successfully added over 10,000 additional daily Covid tests available to the residents of LA County.”

For details and a full listing of “Pick-Up Testing Kit” locations and hours of operation please visit: Pick-Up Testing Kit

The new “Pick-Up Testing Kits” are available to all LA County residents who are experiencing symptoms or believe they have been exposed to someone with COVID-19. To preserve limited resources, the “Pick-Up Testing Kits” are not intended for use by those testing as a requirement to return to school, work or participate in other activities where routine testing is mandated. The “Pick-Up Testing Kits” offer only PCR testing not rapid testing.

Individuals who need to get tested as part of a requirement for work, school, or other activities should seek testing via their employer, school district or the entity requiring the testing.

LA County residents can find COVID-19 testing sites at covid19.lacounty.gov/testing/

All testing locations listed within the county testing website offer COVID-19 tests at no out-of-pocket cost, regardless of insurance coverage or immigration status.

It is important that LA County residents understand that not all COVID-19 testing sites within the LA County region are affiliated or operated by LA County. COVID testing sites are also being operated by private companies, private health care systems and local municipalities and some of these privately operated sites do charge for their testing services.

Only the testing sites listed within the LA County COVID-19 testing website covid19.lacounty.gov/testing/have been vetted by LA County.

As of January 7, 2021 – there are approximately 260 COVID-19 testing locations listed in the LA County’s COVID-19 testing site (covid19.lacounty.gov/testing/), of those, the county operates about 66 community sites and 7 state sites. The remaining locations are operated by testing partners.

Testing partner sites listed on LA County’s website are sites that have been pre-screened by LA County to ensure that they offer testing with no out-of-pocket cost, regardless of health insurance or immigration status and that they offer testing using a test approved by the FDA.

LA County does not have oversight over testing sites not directly operated by the LA County Department of Health Services.

Coronavirus

LA County cases explode as mask mandate extended till February 15

President Joe Biden saying there’s “no excuse for anyone being unvaccinated after U.S. hits 1 million new cases in 24 hours

LOS ANGELES – California Health and Human Services Secretary Dr. Mark Ghaly announced Wednesday that the state will extend its mask mandate for indoor public spaces for another month as an unprecedented wave of the Omicron variant of coronavirus infections continues to inundate the Golden State.

The statewide order was reinstituted in mid-December, and was originally set to be reevaluated January 15. But given the sharp recent rise in infections and hospitalizations, the order will be in place through at least February 15, said Ghaly.

The Los Angeles County Department of Public Health modified its Health Officer Order to include additional safety measures to reduce transmission risks, the Department acknowledging that vaccinations alone are not sufficient to prevent spread of the Omicron variant.

As soon as possible, but no later than January 17th, employers in LA County are required to provide their employees who work indoors in close contact with others with well-fitting medical grade masks, surgical masks, or higher-level respirators, such as N95 or KN95 masks. These upgraded masks are better at blocking virus particles from going through the mask.

The new modifications include an alignment with the State Public Health Officer Order changing attendance thresholds at mega events; for outdoor mega events, the new attendance threshold has been lowered to 5,000 attendees, and for indoor mega events, the new threshold is 500 attendees.

Operators of mega events, performance venues, movie theaters, and entertainment venues are responsible for the messaging, signage, and compliance of masking requirements unless spectators or customers are actively eating or drinking. Additionally, Public Health recommends that food and drink be consumed in designated dining areas.

Lastly, food and drinks are prohibited at card room gaming tables and masks must always be worn while indoors at card rooms, except for when actively eating or drinking in designated dining areas.

As the case count continues to climb, numerous events are being cancelled or moved to a virtual setting. The Los Angeles Times reported that the 64th Grammy Awards will not take place Jan. 31 in Los Angeles, due to the rapid spread of the highly infectious Omicron variant.

The Recording Academy, which presents music’s most prestigious awards show, said Wednesday that “holding the show on January 31 simply contains too many risks” and added that a new date would be announced “soon.”

The Times also reported Wednesday that more than 1,000 police officers, firefighters and paramedics in the Los Angeles region are ill or at home quarantining after testing positive for the coronavirus, spurring additional concerns about public safety as the Omicron variant continues its rapid spread.

More than 500 employees of the Los Angeles Police Department – including 416 officers – were at home quarantining as of Jan. 1 after positive tests, the department said. In the last week alone, the LAPD had seen 424 new cases, officials said.

The Los Angeles Fire Department had 201 employees out due to the coronavirus and the L.A. County Sheriff’s Department was missing 552 employees, including 389 deputies, officials said.

The Los Angeles County courts system will pause all criminal trials for two weeks beginning Wednesday, as infections continue to surge across the region due to the rapid spread of the Omicron variant.

While the coronavirus-positive patient count has more than doubled in the last nine days in Los Angeles, Orange and Ventura counties, a number of the patients who have tested positive in some L.A. County hospitals were admitted for something other than the coronavirus. That is starkly different from what was seen in earlier surges, when most coronavirus-positive patients were hospitalized because they had been sickened by the virus.

Earlier this week, Public Health noted that pediatric hospitalizations increased by nearly 190% between December 4th and December 25th. While the numbers of children hospitalized remain very small, those 0-4 years old saw the biggest rise in rates with a 3.25-fold increase, followed by 12-to-17- year- old teens, who had a 3.0-fold increase, and 5-to-11 -year- old, who saw an increase of 1.5-fold. Cases among children have also increased by 207% from the two-week period starting on November 8th to the two-week period ending on December 26th.

Other cancellations included the Los Angeles Chamber Orchestra January 8, “Strings for the Ages” concert at The Broad Stage.

The City of Palm Springs alerted its residents Wednesday that Mayor Lisa Middleton tested positive for the COVID-19 virus. In a Facebook post, the City wrote:

“Middleton is following medical advice and direction and will spend at minimum the next ten days days at home in isolation as she recovers from what she described as mild symptoms. During isolation Middleton will continue her mayoral duties to the maximum extent possible.

On Tuesday, Middleton woke up with a sore throat and has not left home except to get tested. Following the positive result, Middleton immediately notified the small number of people she had contact with outside of her home over the last several days.

“Since the onset of COVID-19, we in Palm Springs have recognized the need to be extremely cautious when it comes to wearing a mask and have continually encouraged vaccinations and booster shots in order to keep everyone in our community safe,” said Middleton.

“I am grateful for the advice of medical experts, and in particular the diligence of Riverside County Public Health officials. I feel extremely fortunate that my symptoms are mild. The health and safety of our residents and visitors are our number one priority in Palm Springs and I encourage everyone to get fully vaccinated, boosted and regularly tested. This is the best way we can take care of one another,” said Middleton. “We are all in this together.”

On Monday the United States hit a record 1 million new cases in just a 24 hour period. President Joe Biden addressed the nation, saying there’s “no excuse for anyone being unvaccinated.”

Biden Under Pressure As U.S. Hits 1 Million Covid Cases In A Day Amid Testing Shortage:

At the White House, the administration’s point man on handling the crisis, Jeffrey D. Zients spoke to reporters noting:

“The coming weeks are going to be challenging. We’re going to see cases continue to rise because Omicron is a very transmissible variant. But it’s important to stay focused on three things.

First, we have the tools to keep ourselves, our loved ones, and our communities safe. And importantly, we have the tools we need to keep our schools open.

Second, the impact of rising cases depends on a person’s vaccination status.

While we are seeing COVID cases among the vaccinated, if you’re fully vaccinated and especially if you’ve gotten a booster shot — if you’re eligible for a booster shot — you’re highly protected, and it’s very unlikely that you’ll get seriously ill.

But if you’re unvaccinated, you have a good reason to be concerned. If you get COVID, you’re at a high risk of getting severely ill, being hospitalized, and even dying.

So, please, get vaccinated. Get your kids vaccinated. And if you’re eligible for a booster, get a booster shot.

And third, the Biden administration is deploying every available measure to help states, communities, and hospitals confront this Omicron challenge. Military doctors, nurses, and EMTs are now in place assisting local hospital staff in states across the country, with additional teams ready to deploy as needed.

We’ve shipped 2.4 million pieces of personal protective equipment — PPE — in the last two weeks alone to help keep healthcare workers safe.

We’ve established free testing locations across the nation, with additional new sites opening soon in Maine, Maryland, Nevada, Delaware, Texas, and Washington State.

And we’ve worked aggressively to stock our nation’s medicine cabinet with a diverse portfolio of COVID treatments. It’s important to remember that we have more effective treatments available now than at any point during the pandemic.”

He also added; “In addition, we’re working with Pfizer to accelerate the delivery of these pills, and we’ll now have the first 10 million treatment cycles — courses — by the end of June instead of the end of September. These pills can dramatically decrease hospitalizations and deaths and are a game-changer, with the potential to alter the impact of COVID on people and on our nation.”

In Los Angeles Public Health is reminding residents to avoid visiting the emergency room unless they need emergency medical care. Residents should not be visiting the emergency department solely to get a COVID test or for minor complaints that could be resolved through their primary care physician. Emergency room visits should be reserved for those patients who are feeling severely ill – for example, those who are short of breath – or who have serious concerns about their health and who require immediate emergency care.

To keep workplaces and schools open, residents and workers are asked to:

- Get tested to help reduce the spread, especially if you traveled for the holidays, have had a possible exposure, or have symptoms, or are gathering with people not in your household

- Adhere to masking requirements when indoors or at crowded outdoor spaces, regardless of vaccination status

Residents are legally required to be isolated if they have a positive COVID test result and that vaccinated close contacts with symptoms and unvaccinated close contacts need to be quarantined.

For updated isolation and quarantine guidance, please visit www.publichealth.lacounty.gov

COVID-19 vaccines are safe and effective and are recommended for everyone 5 years old and older to help protect against COVID-19. Vaccinations are always free and open to eligible residents and workers regardless of immigration status. Appointments are not needed at all Public Health vaccination sites and many community sites where first, second, and third doses are available.

To find a vaccination site near you, or to make an appointment, please visit:

www.VaccinateLACounty.com (English) or www.VacunateLosAngeles.com (Spanish).

If you need assistance, you can also call 1-833-540-0473 for help:

Finding an appointment

Connect to free transportation to and from a vaccination site, or

Schedule a home visit if you are homebound.

For more information regarding COVID-19 in LA County you can also visit the Public Health website at www.publichealth.lacounty.gov

Coronavirus

LA County records a 91% increase in COVID cases over past 7 days

State officials have for weeks voiced concerns over California’s hospital capacity amid staffing shortages

LOS ANGELES – With Delta and Omicron variant transmissions of the coronavirus surging, the Los Angeles County Department of Health reported more than 16,000 new cases in one of the highest daily case counts of the pandemic Wednesday.

Over the past week, Public Health reported cases have increased 91% (from 8,633 to 16,510), test positivity rates have more than doubled from 8.7% to 17.6%, and daily hospitalizations have jumped over 30% (from 770 to 1,069).

As of December 25th, the Centers for Disease Control and Prevention revised estimates on variant prevalence, with Omicron now estimated to account for 59% of all U.S. infections and Delta for 41% of infections. In the week ending December 18th, 54% of L.A. County sequenced positive cases were Omicron variants.

As transmission of the delta and omicron variants surge, public health officials are urging residents to scale down New Year’s plans by limiting gatherings to a very small number of people, where everyone is fully vaccinated and boosted if eligible. Large, crowded events are just too risky this holiday, the department said.

“As we get ready to welcome the new year, this includes re-thinking party plans, limiting time indoors with non-household members, and isolating from others if feeling sick,” Barbara Ferrer, Director of Public Health said.

State officials have for weeks voiced concerns over California’s hospital capacity amid staffing shortages. In a press conference earlier this month announcing reimplementation of the state mask mandate, Dr. Mark Ghaly, California Secretary of Health and Human Services warned that even a moderate surge in cases and hospitalizations could impact the state’s health care system.

Vaccinations and boosters remain the best protection against severe illness and disease from COVID-19, health officials reminded residents.

“With increasing evidence that vaccinated, and where eligible, boosted individuals have significant protection against severe COVID illness, the best way to limit heartache during one of the worst COVID surges, is to get vaccinated and boosted as quickly as possible,” Ferrer said.

Public Health urged residents to scale down New Year’s plans by limiting gatherings to a very small number of people where everyone is fully vaccinated and boosted if eligible. Large, crowded events are just too risky this holiday.

Individuals who are sick should remain isolated from others, and everyone should wear a mask, even when indoors, if gathering with people not in your household. Vaccinations and boosters remain the best protection against severe illness and disease from COVID.

Coronavirus

Omicron variant & rise in coronavirus hospitalizations has officials worried

The White House announced Saturday that President Biden will address nation on alarming rise in Omicron cases on Tuesday

LOS ANGELES – The Los Angeles County Department of Public Health reported 21 new deaths and 3,730 new positive cases of confirmed COVID-19 in the County Saturday fueling concerns that already burdened hospitals may become overwhelmed over the holiday period.

Across California there were 3,589 COVID-19 patients in the state’s hospitals as of Friday, an increase of roughly 12% from two weeks before, according to The LA Times’ hospitalization tracker. Some Southern California counties have seen bigger jumps, with hospitalizations rising by nearly 31% in L.A. County.

The California Department of Health recorded 49 cases of the omicron variant as of Wednesday. However, the LA Times noted that not all samples were sequenced to identify variants. Currently there are 184,700 identified cases of the Delta variant, which remains the dominant variant, but state health officials say that number is expected to rise.

The Los Angeles County Department of Public Health is urging residents to comply with the newly reinstated state-wide indoor mask mandate. Officials at Public Health noted that the data suggests that public mask wearing is one of the most effective strategies at reducing the spread of the virus when compliance is high.

“Public and business sector masking compliance is high, indicating the broad understanding that this small behavior change adds a layer of protection that enables us to engage in our customary activities without endangering ourselves or others,” An official said in a statement. “Public Health regularly conducts site visits to assess mask compliance across a variety of L.A. County businesses, during which we determine compliance among customers, employees and their staff, and overall safety requirements. Out of more than 1500 site visits conducted between December 4th-10th, the vast majority of businesses and industries, including restaurants, bars, food markets and hair salons, had masking compliance rates above 95%.”

“Masking requirements reduce transmission without much disruption to people’s routines and allow businesses to reduce risk for their customers, and workers,” said Barbara Ferrer, Director of Public Health. “We would like to express our sincere appreciation to the business community of L.A. County for leading by example on masking as champions for public health. The take home message is clear: masking creates safety for employees and customers, reduces COVID transmission in our communities and helps everyone stay safe here in L.A. County.”

State and local health officials are also urging residents to get boosters and if they’ve not been vaccinated to do so immediately.

This week the U. S. Centers for Disease Control endorsed the updated recommendations made by the Advisory Committee on Immunization Practices (ACIP) for the prevention of COVID-19, expressing clinical preference for adults 18+ to receive an mRNA [ Pfizer or Moderna] COVID-19 vaccine over Johnson & Johnson’s COVID-19 vaccine.

As of December 12th, over 530,000 residents in L.A. County have received a dose of the Johnson & Johnson COVID vaccine. County Public Health officials are reminding residents that L.A. County’s supply of mRNA vaccines is abundant and that when it is time to get a booster dose, individuals previously vaccinated with the Johnson & Johnson vaccine should consider boosters with Pfizer or Moderna.

“We appreciate the CDC’s guidance on vaccine choice. While any vaccine is better than no vaccine, we urge those who have received Johnson and Johnson vaccines to obtain booster doses of Pfizer or Moderna vaccines to ensure they are well protected from both suffering severe Covid outcomes and transmitting infection to others,” said Ferrer.

Biden To Address Alarming Rise In Omicron Variant Cases Tuesday

-

Theater4 days ago

Theater4 days agoGeffen Playhouse’s The Reservoir finds queer humor and joy in recovery and loss

-

COMMENTARY2 days ago

COMMENTARY2 days agoUSAID’s demise: America’s global betrayal of trust

-

a&e features3 days ago

a&e features3 days agoHow this Texas drag king reclaimed their identity through Chicano-inspired drag

-

Travel5 days ago

Travel5 days agoManchester is vibrant tapestry of culture, history, and Pride

-

Obituary2 days ago

Obituary2 days agoThe queer community mourns the loss of trailblazer Jewel Thais-Williams

-

a&e features4 days ago

a&e features4 days agoFrom Drag Race to Dvořák: Thorgy Thor takes the Hollywood Bowl for Classical Pride

-

Books5 days ago

Books5 days agoEmbracing the chaos can be part of the fun

-

Television1 day ago

Television1 day agoICYMI: ‘Overcompensating’ a surprisingly sweet queer treat

-

Arts & Entertainment3 days ago

Arts & Entertainment3 days agoMary Lambert Returns With a Battle Cry in new single, “The Tempest”

-

Opinions2 hours ago

Opinions2 hours agoThe psychology of a queer Trump supporter: Navigating identity, ideology, and internal conflict